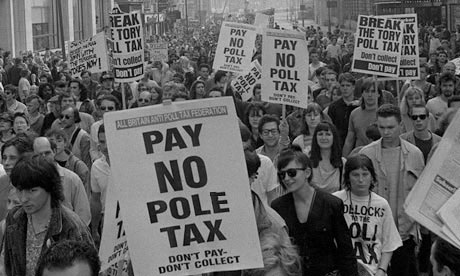

This weekend, the 3rd Circuit Court of Appeals upheld the Texas pole tax against an appeal that charged the tax was an improperly utilized “occupation tax.” Officially known as the Sexually Oriented Business Fee, the tax requires strip clubs to pay $5 per patron to a fund for victims of sexual assault. While similar taxes… Continue reading Texas Can Tax Twerking Contests, And Other Pole Tax News

Category: Strippers

Love and Frosting: A Conversation With Portland’s Cupcake Girls

“But how should I address the invitations?” the young brunette across from me asked. “Husband first, so ‘Mr and Mrs blank,’” advised the older woman next to her, and everyone nodded. I blinked and made a note, tried not to look confused or judgmental. I was at a planning meeting for It’s a Cupcake Christmas!,… Continue reading Love and Frosting: A Conversation With Portland’s Cupcake Girls

Sweat Pants Boner Man Speaks: A Tits and Sass Exclusive

Frost and Nixon. Cronkite and Thatcher. Amanpour and Arafat. O’Reilly and Obama. Today, Tits and Sass brings you what will certainly be remembered as another essential interview in the history of journalism. We all have met him. Every single one of us has been touched in a very special way by this storied individual. Who… Continue reading Sweat Pants Boner Man Speaks: A Tits and Sass Exclusive

I Know Who Killed Me (2007)

I love Lindsay Lohan. When her issue of Playboy dropped I raced to the corner store to buy it. Who doesn’t love a Disney princess gone porno? In I Know Who Killed Me, released in 2007, Lohan plays a stripper who, through a twist of events, winds up an amputee. When LiLo accepted the role… Continue reading I Know Who Killed Me (2007)

My Awkward Sexual Adventure (2012)

Most readers will not have heard of the low-budget Canadian movie My Awkward Sexual Adventure. I had to review it because a) it was filmed in my hometown of Winnipeg, Manitoba b) one of the protagonists is a stripper (in fact, the club she works at in the movie is one that I work at… Continue reading My Awkward Sexual Adventure (2012)