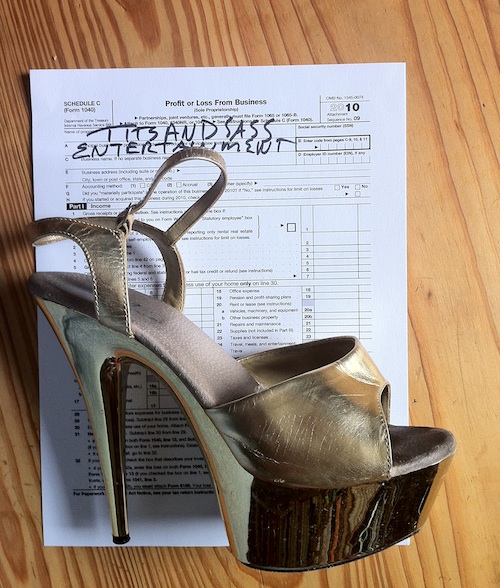

Happy Tax Day! I don’t know why we got an extra day after Sunday to file, but it’s not like it made a difference for me, because I thankfully have an accountant handling my mess. If you are a sex worker who is maybe confused about how to handle filing, how to determine if you’re an employee or self-employed, or why you should file at all if you’re paid entirely in cash, please look at our post from last year, “Five Reasons Sex Workers File Their Damn Taxes.”

Melissa Gira Grant spoke to Buzzfeed about sex workers and taxes.

We’ve had a series of posts about how strip club owners have been tripped up by failing to pay their damn taxes.

Here’s a post by Story about her helpful accountant.

And here’s one I wrote about my own tax issues.

You might like to check out the Tax Domme, who is very knowledgeable about the industry.

Strip and Grow Rich also provides helpful tax advice for strippers.

If you’re on the fence about filing or nervous because you haven’t filed in the past, it’s really not as scary as you think. And it’s definitely better to deal with it yourself than to be made to deal with it down the road. Please feel free to post any tax-related questions in the comments and we’ll be happy to give you our (totally not professional and completely informal because we are not tax professionals et cetera) thoughts.

April 16th is a holiday in Washington DC (emancipation day). Since IRS was closed in DC everybody got an extra day.