The filing deadline for your IRS tax return is Tuesday, April 18. You can file for an automatic extension with this form.

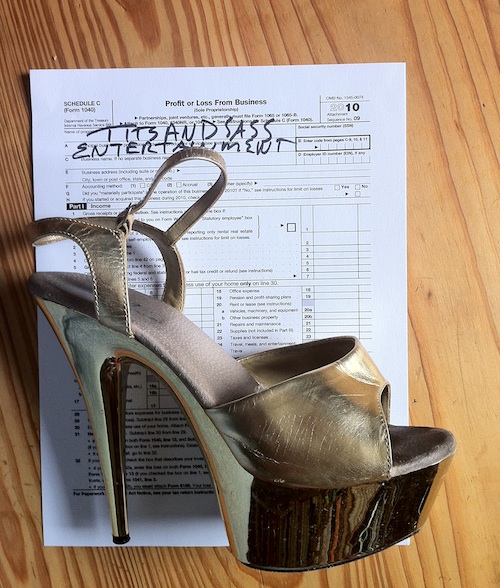

In the last couple of weeks I’ve read sex workers on Facebook and Twitter talking about the difficulties they had in getting an apartment, qualifying for a car loan, and signing up for health care because they didn’t have any proof of income. “I don’t get paychecks,” the sex worker might say (unless she is an employee), “So how can I prove how much money I make?” I read dancers telling other dancers to get a strip club manager to write a letter estimating what she makes in a week, and while that might work to buy a car at You Work—You Ride! it won’t help with big leasing companies or the bank.

What will help is having a copy of your tax return. Even before you file it, make a copy of your completed return to have on hand for any occasion that requires proof of income. It doesn’t have to be complicated; if you take a look at the Schedule C and panic at all the deduction categories, if you don’t save receipts for anything, if you haven’t filed in years, if you’ve never filed during your sex working career, just remember this: don’t panic. You can do this. All it is is counting money and adding and subtracting it.

Well. And paying it. That part is no fun. But if you’re filing as a self-employed person, you’re supposed to pay quarterly estimated taxes, which is somewhat better than paying one chunk in April, and hey, at least you don’t have to get depressed looking at a deduction on a paycheck every couple of weeks. OK, it’s unpleasant. There’s really nothing less fun to do with your money than send it to the IRS other than using it to pay for car repairs or dental work.

We are not accounting or tax professionals here at Tits and Sass but I, for one, am a career stripper who had her own tax missteps in the past (the part where I pretty much forgot to file the entire time I was in college) (and I was in college for a long time). If I could get straightened out, so can you. Let me be clear that I’m not urging anyone to pay taxes for any other reason than to make their own life easier. I do, however, want to emphasize how it can make your life easier:

1) Tax returns are the only proof of income you have if you’re self-employed and paid mostly, if not entirely, in cash.

2) It’s far better for the IRS to have your numbers to start with than to let them come up with their own.

3) If you get caught after not paying taxes for a number of years and get hit with a five-figure bill, it really sucks.

For expansion on this, you can refer to this old post here, and this Awl post, “Here’s What Happens If You Don’t Do Your Taxes” (it’s a TurboTax sponsored post but it’s also right on). There’s even a whole book specifically targeted towards sex workers, The Tax Domme’s Guide for Sex Workers and All Other Business People.

If you’re confused about how to pay your taxes as a self-employed person, any tax guide for freelance writers, who are in a similar situation except with less money and probably none of it in cash, will help. This one on The Billfold is pretty good.

Or find an accountant. They aren’t that expensive and they’re worth it. One who’s experienced with musicians or other kinds of performers and freelancers will probably be able to do a good job for you. But if you can’t afford to pay someone, do the best you can and file even if you can’t pay right now. Every time you decide not to, you’re giving the IRS more power should they ever decide to check up on you.

If you just need some general assistance, almost every community offers free or reduced-priced tax preparation assistance. Check libraries, senior centers, and community centers for listings. Or use the IRS’s handy dandy tax prep locator tool here.

A word of warning, especially for strippers: Beware of anyone coming into the club telling you they’ll get you a fat refund even if you haven’t paid anything. At one Dallas club, a woman got a lot of dancers to give her their information and then committed mass identity theft/tax fraud and absconded with the checks from the IRS. Tell your girls in the dressing room to verify anyone they decide to work with and not to give their information to sketchy independent tax preparers.

This post originally appeared in 2014.

I apologize in a advance for any whiplash caused by this tangent. In the US, from a fairness point of view, you can make a good argument that sex workers should not pay taxes on their compensation. Consider a non-working spouse. If anyone ever really got married to have an unpaid maid, that’s clearly a thing of the past. Non-working spouses provide companionship and sex, just like sex workers. There is no tax on the support that a working spouse provides to a non-working spouse. In fact, the working spouse pays LESS taxes on their income because they are married. If things were fair, not only would sex workers pay no income taxes, johns would get a tax credit based on how much they spent on sex workers.

lol Want to bet on just how fast the government would legalize if they a) knew how much they didn’t get in revenue from this, and b) someone successfully used this as a defense against the IRS.

I’m a lil’ late to this tax party but the article was still featured across the main page’s header; I had to click on it because I love the topics of taxpaying, tax preparation, and generally dealing with the IRS (even as a taxpayer in collection status).

I’ll venture a guess that John Punter is not a tax attorney. Dude, I agree with your premise wholeheartedly – in theory. That said, a sex worker that’s not an employee, aka a self-employed sex worker, is asking for eventual IRS trouble if she doesn’t file and pay taxes. The only occasions she’d have to furnish the IRS with your “good argument” (based on – or analogical to – what actual legal premise?) is

1) when she files a tax return saying she earned $XXXXX that year but owes zero in taxes because [Punter reasons], whereupon the IRS will say “Great! Thanks for alerting us to the fact that you owe taxes because you got taxable income!” or

2) after the IRS sends her a notice of deficiency, whereupon the IRS will say “Great! Thanks for wasting the 60 days you had to give us an actual argument based on your factual circumstance and our legal standards for tax exemption, let us now assess what we suspected you owe and show you why we’re the country’s most powerful collections agency!”

Paying taxes sucks, but it shows you’re a grownup that can mentally connect concepts like mid-term financial planning, overall goal-setting, and fulfillment of civic duty with things like well-paved roads, public libraries, trash pickup, payback for any public education one might have benefitted from, unemployment/worker’s comp (for anyone you ever knew or cared about, as well as yourself), Medicaid (for those who live in expansionist Medicaid states), and such (paying for unjustified wars and domestic espionage notwithstanding – that is a valid argument but doesn’t negate all the other things taxes fund).

In short: don’t use Mister Punter’s Made for the USA teabagger reasoning to get out of paying taxes. There are alternatives to dodging your tax liability and trying to use this flimsy excuse to vindicate that decision, alternatives that are soundly grounded in the realities of being an income earner and a member of society, however marginal any or all of those could be. None of this is legal advice; but tweet @ me if you have questions or need more information.

I’m not a tax attorney, but I recently put in a few hundred hours as a student attorney representing taxpayers in collections before the IRS. I’ve also been programmed to uphold the pillars of civic duty (namely voting, serving jury duty, and obvs paying taxes) and I have to say, the IRS knows it can’t draw blood from a stone. Don’t try to act like a stone, is all.

Self employment tax starts at $400 annual income.

(It is quite possible that there are class conclusions to draw from this, though I am no expert.)

Here’s an estimate calculator to help you get an idea of how much you’ll owe as a freelancer: https://www.calcxml.com/calculators/self-employment-tax-calculator

Good luck everyone.

I’m a retail-level tax preparer (US, approximately 5 years in the tax industry with some experience with self-employed clients). Obviously too late for this year’s main filing date, but my sock email should you have questions is sockitup2015@hotmail.com.

(I am not a CPA or tax attorney, nor am I who you want to talk to/bring with if you’re American and the IRS has requested an in-person meeting).

In general: receipts are good (self-employment income with no expenses is pretty much an instant red flag. Stage wear/lingerie/etc. is generally considered a deductible expense so long as it’s not something you’d wear to the store or whatever when not working. If you work from home, *portions* of your home rent or mortgage/internet bill/etc. may be deductible but pretty much only if you have a dedicated portion of your home that is *only* used for work. Vehicle expenses for people traveling *may* be usable but there’s some specifics you need for the vehicle in question and pretty much this only applies to road-trip or outcall.)

And yes, estimated taxes can be your friends, because otherwise unless you’ve been saving for the roughly 17-20% tax on gross income that self-employment starts out at you can be seeing a CHUNK in April. (Even if you can’t pay a dime, if you’re able to FILE you just can’t *pay* try to file on time. You’ll still be racking up income penalties, but the legal consequences are lessened and if you end up needing to set up a payment plan the IRS may well be more sympathetic.)