1) Tax returns are the only proof of income you have if you’re self-employed and paid mostly, if not entirely, in cash.

2) It’s far better for the IRS to have your numbers to start with than to let them come up with their own.

3) If you get caught after not paying taxes for a number of years and get hit with a five-figure bill, it really sucks.

4) You become another person contradicting the stereotype of sex workers as tax cheats who don’t contribute to society.

5) It makes you (even more) morally superior to GE.

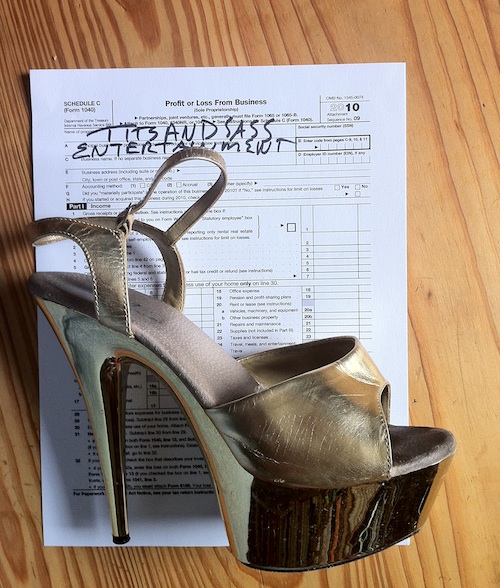

Things you need to file if you are an independent contractor stripper/model/performer/camgirl, an escort, sensual touch provider, etc:

Form 1040

Schedule C for income from a business (you are a business)

Form 8829 for home office deduction (you have a computer in your home where you’re doing business, yes?)

Your receipts for work-related supplies, travel, and other expenses

Records of your income

Even if you lack accurate records, give it your best shot and file. Even if you can’t pay right now, file. Even if what you do is illegal, file (you don’t have to write down what you do. We are all “entertainers”). Read this piece over at the Awl for some good reasons why you should file no matter what. It’s so, so much better to have YOUR realistic numbers than to have the IRS say, “Hey, we have this 1099 from your club, where you sold $1500 in VIP rooms, so we’re assuming that was a normal night for you, so we’re calculating your tax debt based on that,” or “Well, we saw on this 20/20 special about escorts that $2000/hour is a rate people pay in New York, so let’s start there.”

I don’t care if you’re gonna fudge it! Don’t tell me about it. Don’t tell anyone about it, for that matter. I’m not telling you to file because I think we owe it to the country or because I’m a bleeding-heart liberal or because I think the Tea Party is supremely misguided because they aren’t storming the gates of GE and Bank of America to demand they bear their burden of the tax load. I’m telling you to do this because it COVERS YOUR PRETTY PROFESSIONALLY SEXY ASS. Having personally fucked up with taxes before and knowing several dancers and escorts who’ve been in deep shit with the revenuers, I speak from experience when I say it’s to your advantage to stay on top of your taxes.

Also, you have until Monday. Yay Emancipation Day!

Amen sister! Don’t forget, as a sex worker, nearly everything is tax deductible. My sex positive accountant said that any attempt to stay current in pop culture (movies, books, theater) was deductible – as you need to have something to chat clients up about, plastic surgery – partially deductible, most my shoes, fetish cloths, sex toys… It adds up and it’s awesome!

I can’t wait for the new book about taxes comes out from the Tax Domme!

This is of EPIC importance. So well written, all I can add is WERD, yo!

Alright, more to add; the POWER of acquiring wealth. You can not have this without filing. Seriously.

Don’t do Form 8829

a) complicated form

b) you have to have a business purpose (your business would fail, but for …)to deducting anything so unless your business is in your home, dont deduct it. If you need a computer to run your business, deduct that on Form 4562 (use the section 179 deduction and deduct the whole thing at once).

c) this form has a high risk of audit

Also, expenses of illegal activities aren’t deductible (sorry; pro-tip: charge a separate fee for the illegal stuff). However, income from illegal activities are taxable (ask Al Capone). They go on Form 1040 as “Other Income.” You don’t have to state that your activities are illegal, fortunately.

Also deductible:

* Mileage (also Form 4562)

* your car (if you need it to get to your independent contractual arrangement – again, 4562)

* Anything you wear that can’t/shouldn’t be worn in public and/or uniforms (but not lingerie)

* music you use for your performance (if applicable) with receipt

* benefits, like health insurance that you provide yourself

* meals if your with a client or person you do business with

* ENTERTAINMENT

Dan, thanks for your dudesplanation. If you are an accountant or tax attorney I’d love to hear more of your reasoning.

I’d like to make an important point: sex workers should get their tax advice from professionals and not strangers on the internet (even us!) or people in the club precisely because everyone’s situation is different and only a tax pro can help shoulder/buffer the liability if there’s a mistake. My accountants have always had me file an 8829 and have consistently told me that travel to and from a regular place of work, even if you are an IC, is commuting and therefore not deductible mileage (travel to a club that’s not your home club can be).

And? No fucking shit you don’t have to declare that you’re engaged in illegal activities on your 1040. I’m not sure if that comment came from pure condescension or actual experience, but in either case I’m appalled you found it necessary to include that.

Regarding tax advice, get a couple of opinions the first year or two until you find the qualified person you like to work with.

Bubbles, consider getting a second opinion on your situation regarding 8829. See top of Page 4 of Pub 535 (IRS.gov) which outlines the tests for business home use. In short: Test 1 – Exclusive use. Test 2 – blah blah blah (you have to prove this stuff) . If your business is in your home, you are probably fine. If your business IS NOT primarily in your home, but you use your home for business (I know …), you can still deduct some of the expenses. Example: you use your computer and phone to make appointments and keep in touch with clients. You use your computer and phone for personal use, too (say, chat with friends and family). You can deduct your computer, the desk, the chair, the internet bill, cell phone; adjusted for the percentage of business use. This goes on Schedule C (some could spill on to 8829 as indirect expenses too I suppose).

Travel, commuting, and business use of a vehicle all have specific meaning in the IRS code. Travel is something you do, generally, when you are away from your home and your regular place of business. Degrees of business purpose equals degrees of deductiblity, in general. Commuting is traveling from your home to your place of work and is not deductible, in general, but if you have more than one regular place of business or other business related mileage, tracking mileage and vehicle deductions become important (at $0.51 cents a mile). If you, then, have some business use of your vehicle, then you can deduct expenses of maintaining that vehicle.

And? I fucking shit you not! If you don’t explain basic facts to some clients, they go an assume shit like “I should be completely honest and forthright about what I do for money with my government.”

For everyone out there in cyber space, print this out and show it to your tax dude/dudette. This will help frame your discussion about your situation.

tl;dr Magnets

So, I frequent the site and leave some messages here and there. Still, I’m not leaving an easy digital trail of my confessions on the tax topic. I don’t necessarily want to seek out a too-honest accountant and blow my cover before asking for a little “informal” advice from T&S readers/contributors.

On my 2009 taxes–filed by H&R Block, as I didn’t know of any accountants and was still pretty new to dancing that January–I claimed $23k in income. About $12k was from working jobs with W-2s before dancing, and the rest from the end of the year when I started. The income was accurate for those months, because it was small from being new and because I didn’t know any better than to be honest, essentially. All good–my bill was only about $500. Paid in full by April 15th, yes.

I went to file my 2010 taxes with a mental war: claim 80% of my income so that I can eventually own property and not get sneers when I attempt to buy a car with tax documents as my only income proof, OR claim as little as possible and pay as few taxes as possible? I have quite a few bills I pay with stripping money, What I did was meet somewhere in the middle, at H&R Block. Again, dumb, but hey…I’m trying to fix these things now! I never paid those taxes or the horribly outrageous bill from them, so…H&R Block has the receipts and information I gave them until I pay them. Except my taxes amount to about $8k…and…uh, I seriously can’t pay that. Not by a long shot, and not over a year of time.

Do I go back to H&R, pay them but tell them not to file and to give me all of the documents/receipts back? Is that even legal? Do I forget about it and aim to file a low income and just pretend I “forgot” about my 2010 taxes?

I want to pay taxes. I’ve wanted to pay taxes all year. I consider it the smart thing to do, and have kept a log of my income since Day 1. But I got myself into a bind and don’t know what to do about it. And, I don’t have the ability to pay more than about…say, $2-3k a year.

Any thoughts, stripper (and accountant) pals? I’ll check back once in awhile to see if there’s any ideas. I’m a little paranoid about tax evasion, yep. I’ve swept it under the rug since April, yep.

We’re working on getting you an answer. Stay tuned for an upcoming “Dear Tits and Sass” on this topic.

Thanks! My problem becomes: If I claim “a good portion of” my income, and end up with the high tax bill I can’t pay, I’m worried about 1) getting in trouble for not being able to pay, 2) having to work more (to make extra money to pay taxes with) and then getting taxed again next year on a higher income…in a perpetual cycle of unpayablenss.

😀 This has been worrying me forever.

Thanks for all this useful information. Has anyone provided a potential solution for the anonymous stripper?

I know this is really late AND I completely identify…

I had to get tax extensions a few times. I had to make monthly payments and pay interest and it sucked but it was my only option. I also did quarterly estimates for 7 of the 8 years I danced. I can’t understand why anyone wouldn’t, it made it so much easier. Also, don’t skimp on a good accountant. I worked at a fairly upscale gentlemens club 90% of my time dancing and it was through the owner that I found my accountant and lawyer.

Paying my taxes allowed me to easily buy cars, have a few credit cards (with low interest rates) and a buy my own home. It feels good to see my credit score. But don’t think I didn’t make mistakes a long the way!

Your accountant is your advocate. He is supposed to act in your best interest. Pay them for the work they have done and tell them you do not want them to file. They have no interest in your dealings if they are not signatory to your return.

For anyone looking for tax help, check out this article: http://www.camgirltoolbox.com/camming-tax-advice-doing-taxes-as-a-camgirl/

It goes through all the writeoffs you can have to make sure you save as much as possible!

Hi. I’m trying to just get the business license in the first place. I independently escort and even offer dances to my clients if that’s what we agree on. I’ve tried looking up which type of lisence I should get but there are so many options and I don’t know which one to select. I’m on wa state of it helps.

Hi,

I recently became a phone sex operator in New Zealand. And I have no idea about taxes. I want to do the right thing and pay anything I owe. I got paid $70 in one hour and I’m just confused on whether I hire an accountant or what? I’m 20 years old and I’m basically doing this nly to pay for uni. I don’t use a computer or anything, only my mobile phone. Any help will be greatly appreciated. Thanks!